Collars And Price Floors Caps

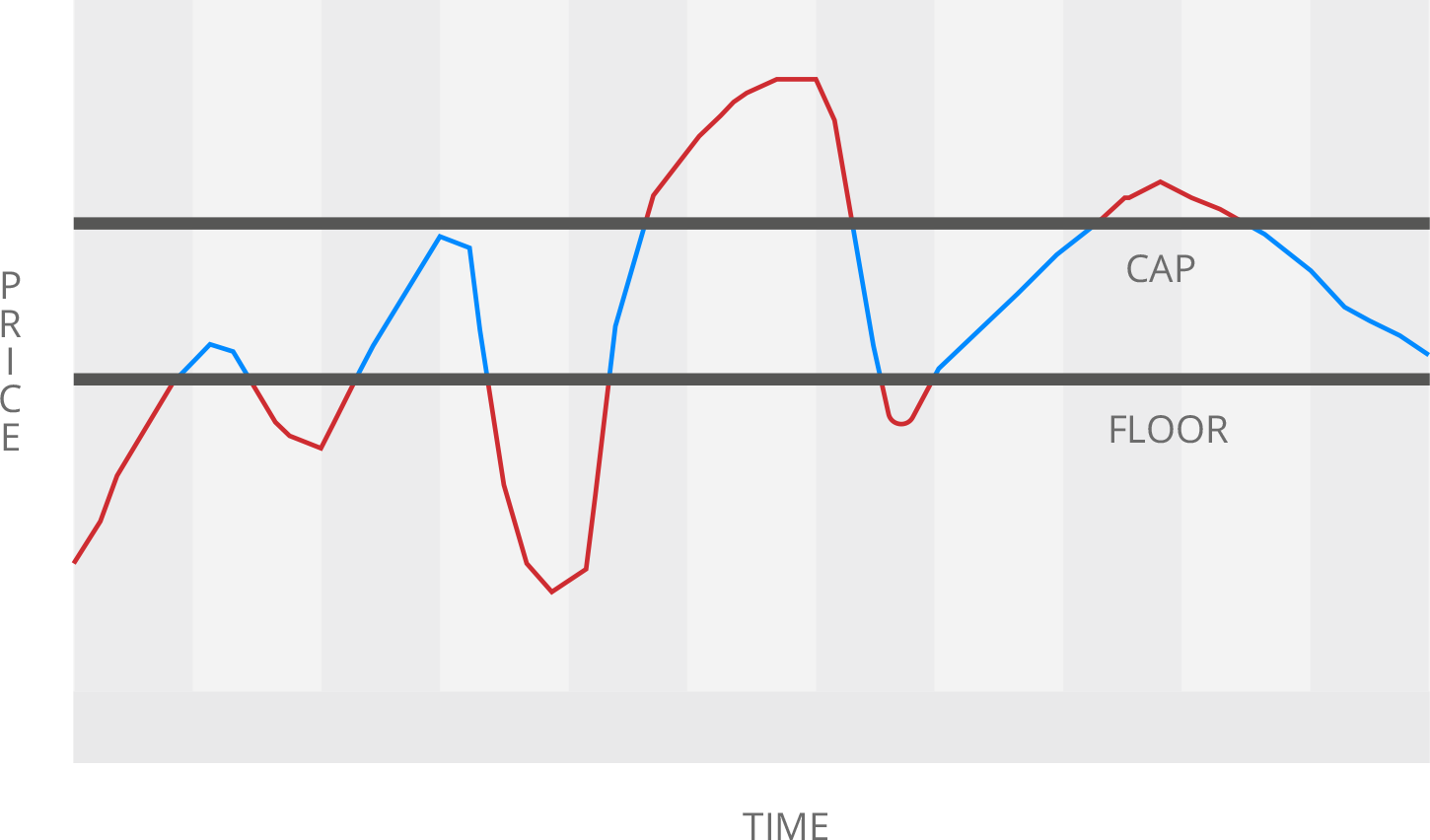

An interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

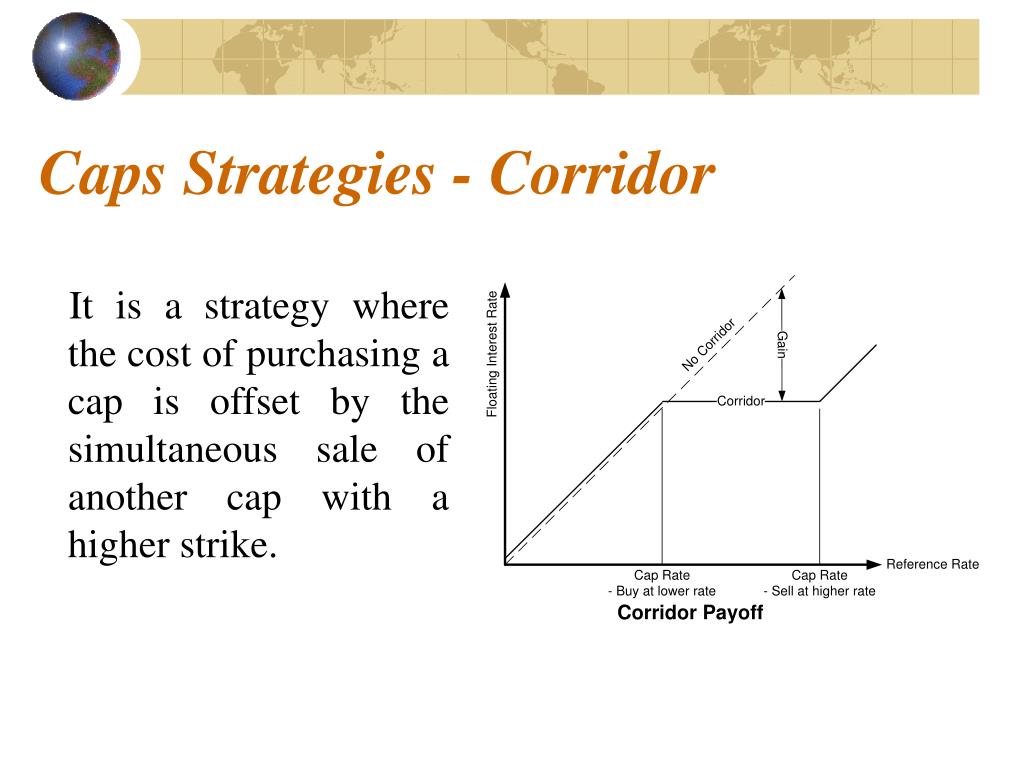

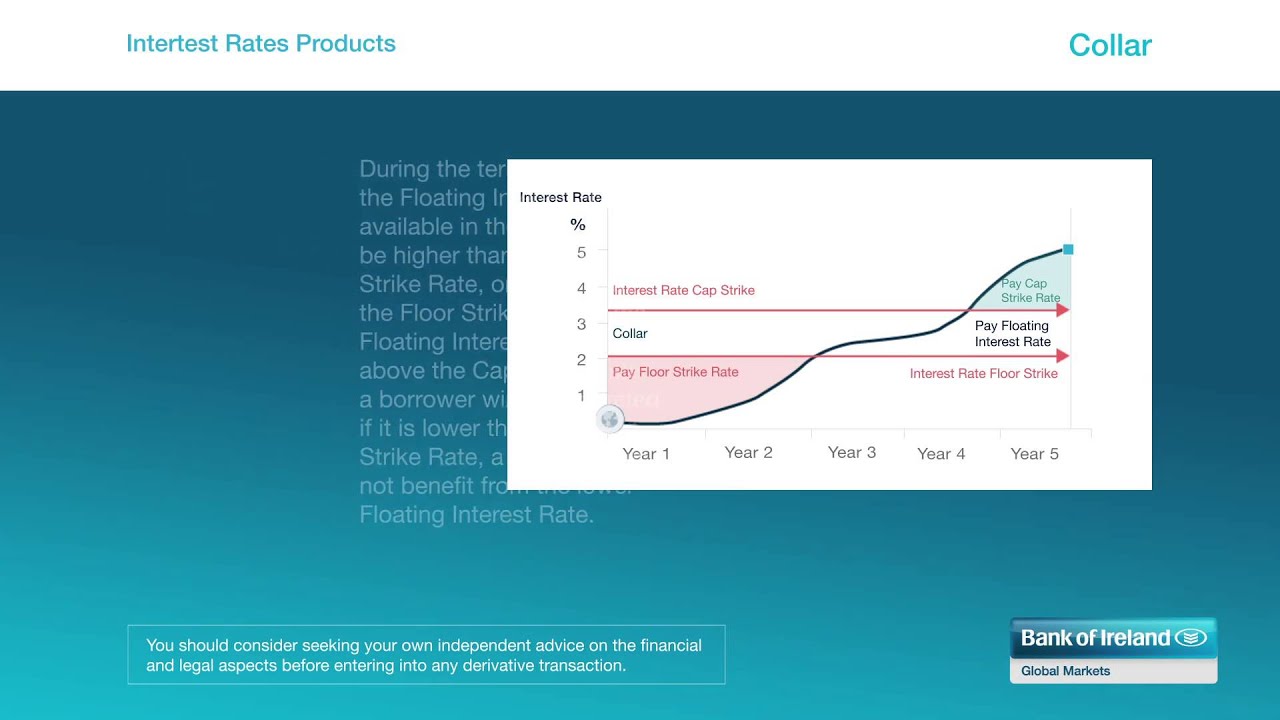

Collars and price floors caps. Floor payments time 0 time 0 5 time 1 5 54 6 004 0 4 721 6 915 5 437 0 1395 4 275 consider a 100 notional of 1 5 year semi annual floor with. Interest rate caps floors and collars these option products can be used to establish maximum cap or minimum floor rates or a combination of the two which is referred to as a collar structure. Unlike for other options the system does not use the option data tab page to map caps floor and collars the option information is contained within the condition data and in the cash flow generated on the basis of the condition data. These products are used by investors and borrowers alike to hedge against adverse interest rate movements.

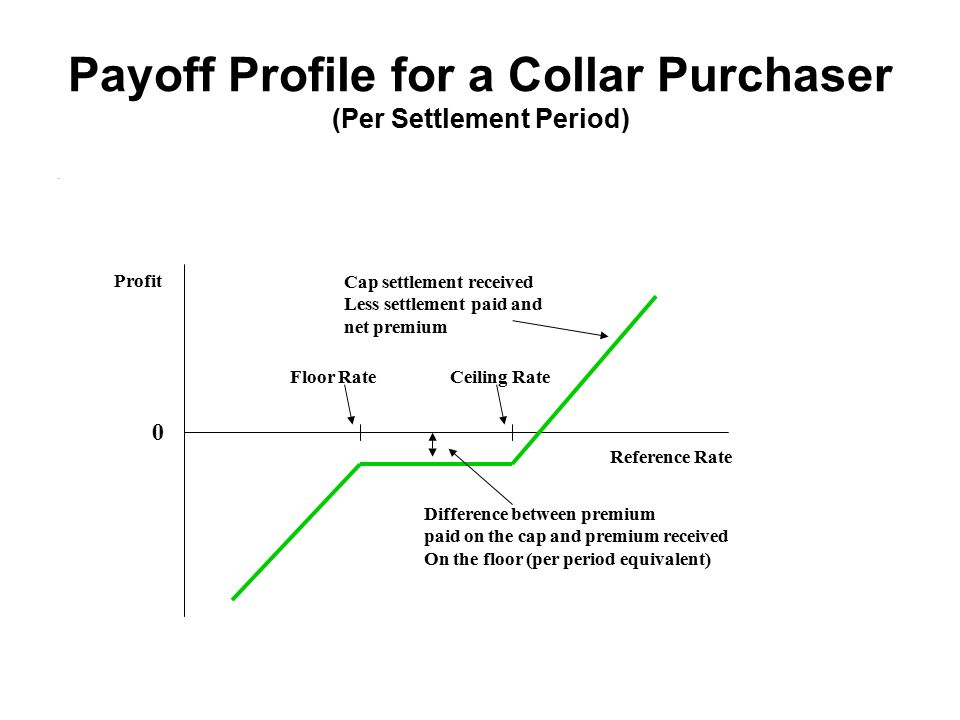

Buying a put option at strike price x called the floor selling a call option at strike price x a called the cap. An interest rate collar can be created by buying a cap and selling a floor. They are most frequently taken out for periods of between 2 and 5 years although this can vary considerably. These latter two are a short risk reversal position.

While the collar effectively hedges. This creates an interest rate range and the collar holder is protected from rates above the cap strike rate but has forgone the benefits of interest rates falling below the floor rate sold. Underlying risk reversal collar. You use template s40caflcol to map caps floors and collars as unstructured transactions in the source data layer sdl.

Cap and floor payoffs and interest rate collars.

:max_bytes(150000):strip_icc()/strategy-4086857_19201-23485cf7c4bf4dbbb95c93f267285f16.jpg)