Convertible Bond Floor Price

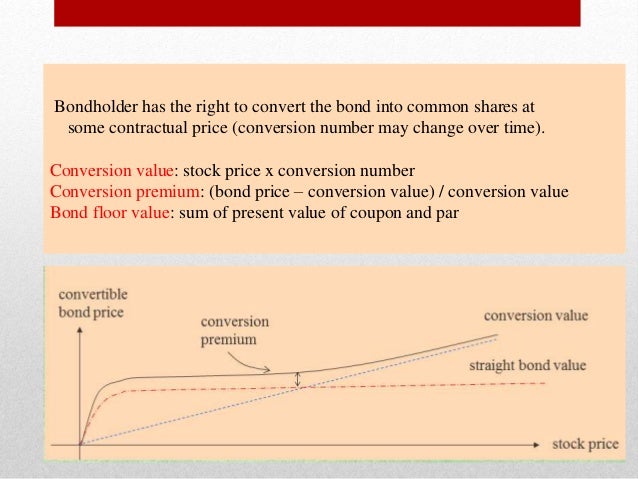

The par value of convertible bond per share of common stock is called the conversion price i e.

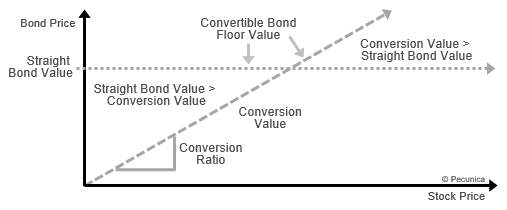

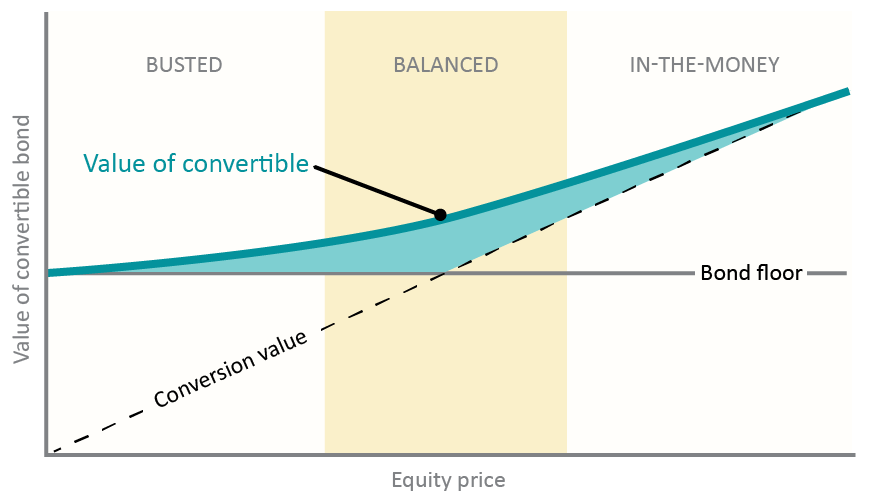

Convertible bond floor price. Divide the convertible bond s face value by your step 5 result and add this calculation s result to your step 8 result to figure the bond s floor value. The bond floor is the value at which the. For example if a 1 000 par value bond can be converted to 20 shares of common stock the conversion ratio is 20. Convertible bonds are a hybrid debt instrument issued by a corporation that can be converted to common stock at the discretion of the bondholder or the corporation once certain price thresholds are achieved.

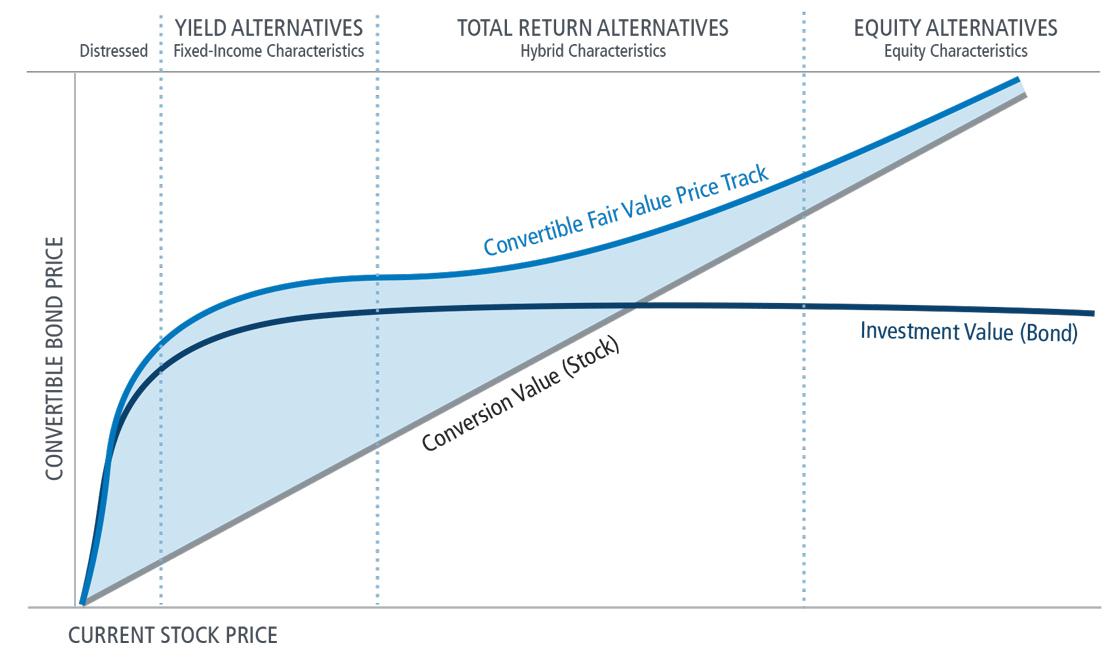

The convertible bond will outperform the company s stock when the stock declines in value because the convertible has a price floor equal to the straight bond value. The convertible bond will underperform the company s stock when the stock appreciates significantly because the investor paid a conversion premium on the convertible bond. If the bond is held until maturity the investor will be paid 1 000 in principal plus 40 in. The floor value of the convertible bond is the lowest value to which the bond can drop and the point at which the conversion option.