Cov Mat R Finance

Tax lien sale virtual outreach sessions.

Cov mat r finance. Suppose our data is in dat. Cross covariance matrix computes the cross covariance matrix between two sets of locations for a spatial random process with a given covariance structure. Smart beta is what people call algorithms that construct portfolios that are intended to beat market cap weighted benchmarks without a human. Portfolio r functions for portfolio analysis to be used in introduction to computational finance financial econometrics last.

Useful financial r snippets making smart beta portfolios in r making smart beta portfolios in r here we explore smart beta and how to build portfolios which implement smart beta in r. Dat dat c 2 4 remove team name and ds names left in data frame names dat 1 playername mb game reshape from long to wide dat wide reshape dat direction wide idvar game timevar playername dat wide 1. The returned object is of class portfolio. The diocese of coventry multi academy trust.

I think what you first need to do is reshape the data so that each row is a game and each column is the mb for a game for a player. Department of finance 311 search all nyc gov websites. If short sales are not allowed then the portfolio is computed numerically using the function samp solve qp from the samp quadprog package. Typically the two sets are a learning set and a test set.

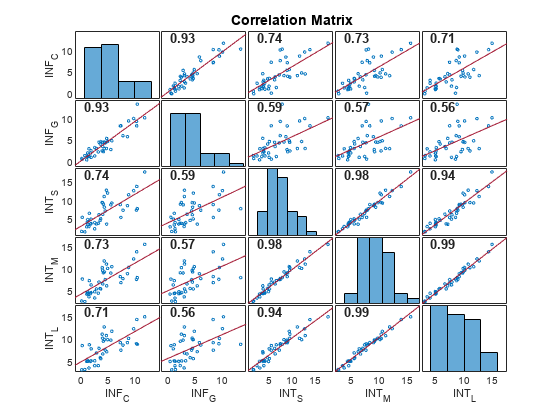

Type package title covariance matrix estimation and regularization for finance version 1 1 0 description estimation and regularization for covariance matrix of asset returns. An exempt charity and a company limited by guarantee registered in england and wales no 8422015. Property records acris contact us. R functions for portfolio analysis my r functions on class webpage in portfolio r and portfolio noshorts r r packager package portfolioanalytics on r on r forge extensive collection of functions rtirme trics package fp tf lifportfolio extensive collection of functions r package quadprog solve qp for quadratic.

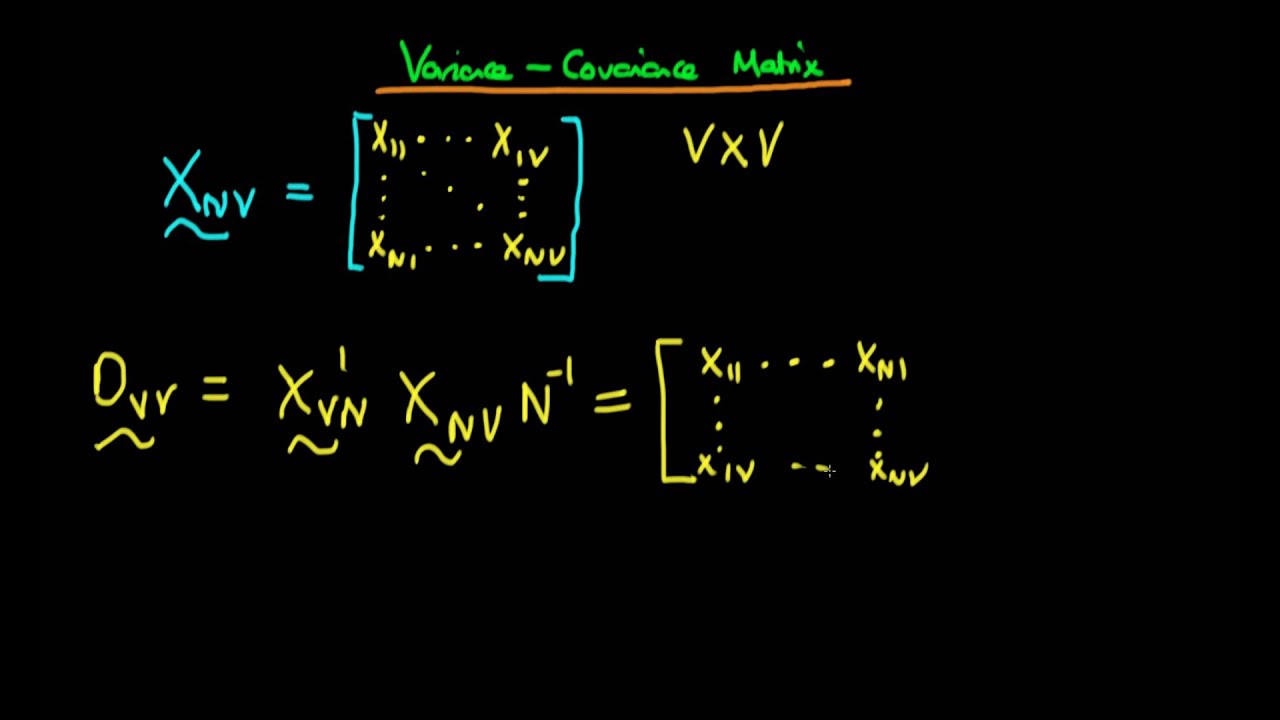

Er n x 1 vector of expected returns cov mat n x n covariance matrix of returns weights n x 1 vector of portfolio weights output is portfolio object with the following elements. Param er samp n x 1 vector of expected returns param cov mat samp n x n return covariance matrix param target return scalar target expected return param shorts logical if. Description compute global minimum variance portfolio given expected return vector and covariance matrix. For covariance matrix estimation three major types of factor models are included.

The portfolio can allow all assets to be shorted or not allow any assets to be shorted.