Deadweight Loss On A Graph Price Floor

Taxes and perfectly inelastic demand.

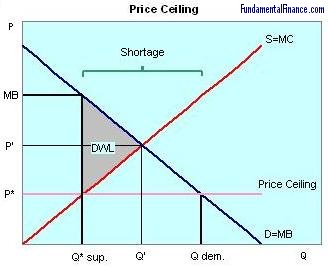

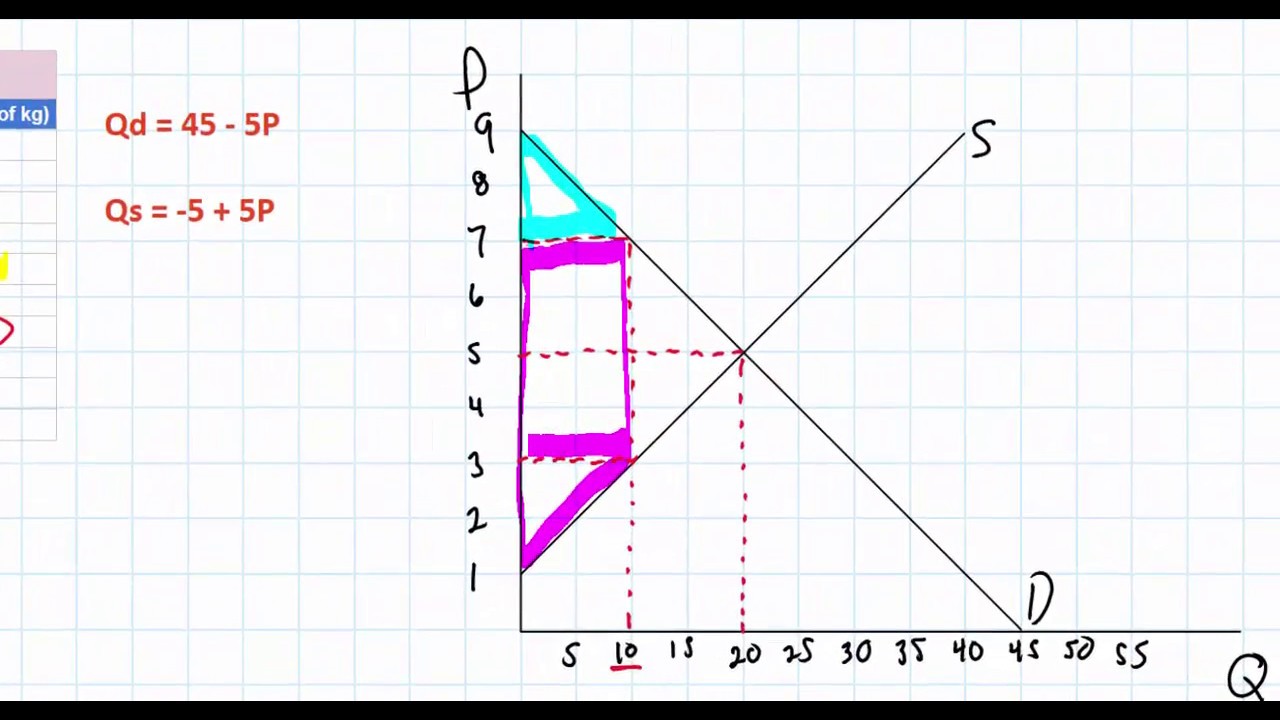

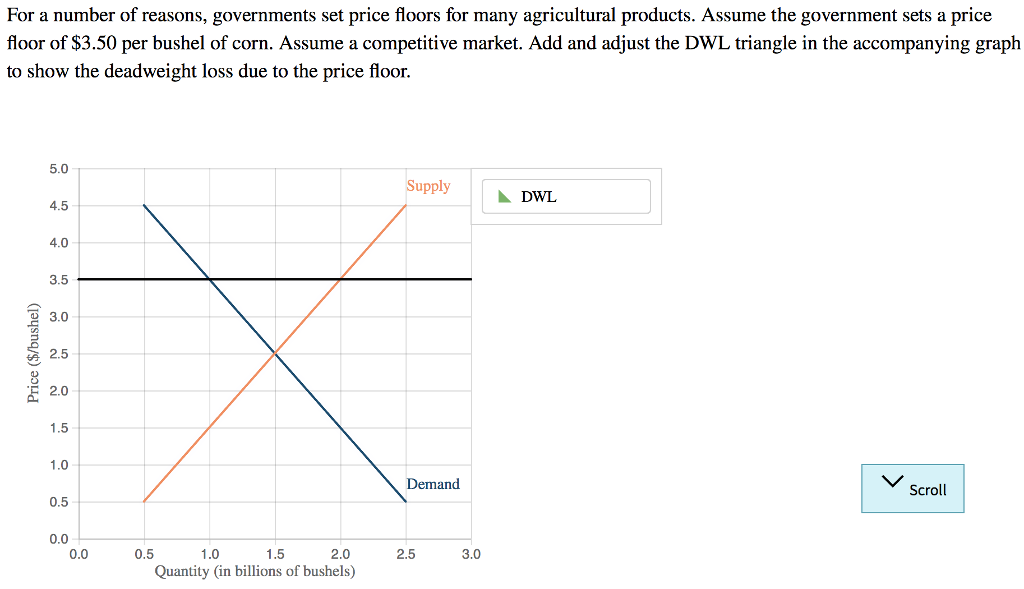

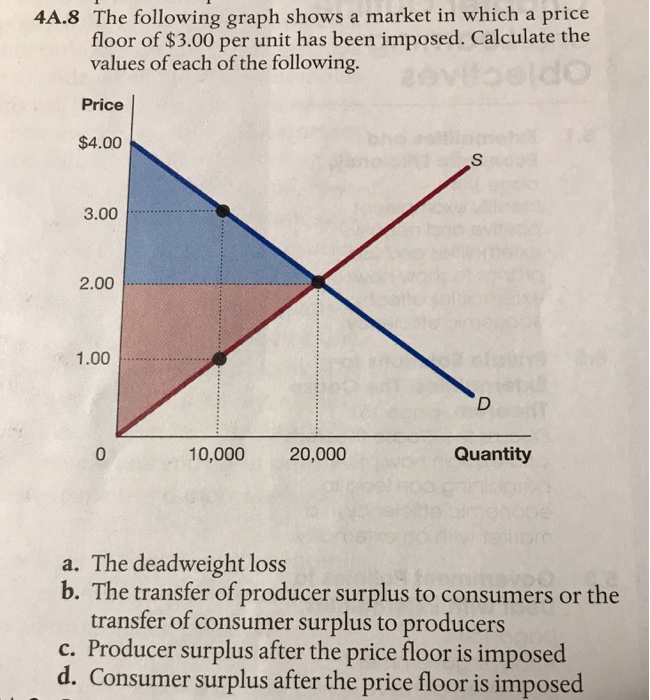

Deadweight loss on a graph price floor. You ll notice that the price floor is above the equilibrium price which is 2 00 in this example. This graph shows a price floor at 3 00. An example of a price floor would be minimum wage. With a reduced level.

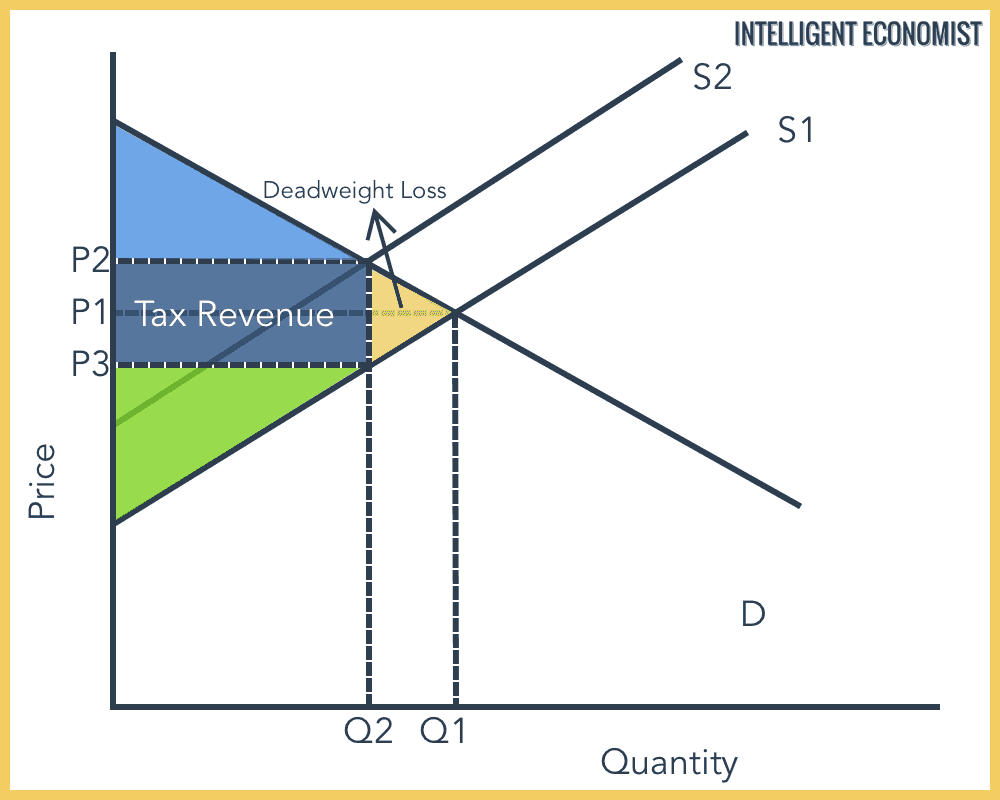

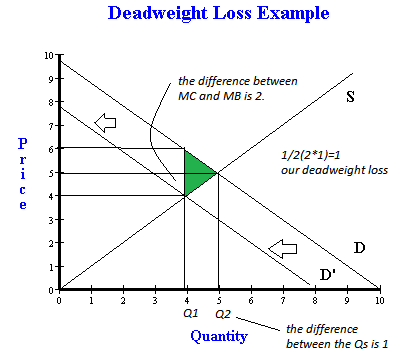

Percentage tax on hamburgers. Price ceilings and price floors. Deadweight losses can be caused by numerous economic factors including price floors e g. Taxes and perfectly elastic demand.

Price ceilings such as price controls and rent controls. Harberger s triangle generally attributed to arnold harberger shows the deadweight loss as measured on a supply and demand graph associated with government intervention in a perfect market mechanisms for this intervention include price floors caps taxes tariffs or quotas it also refers to the deadweight loss created by a government s failure to intervene in a market with externalities. Simply draw a straight horizontal line at the price floor level. Example breaking down tax incidence.

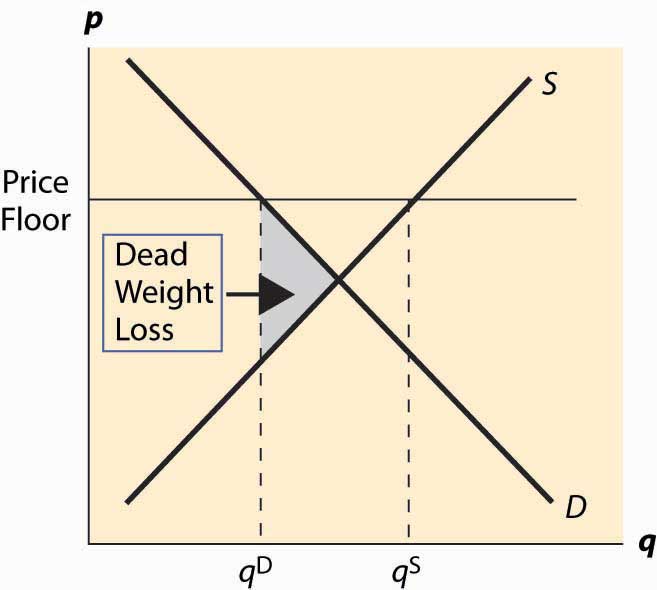

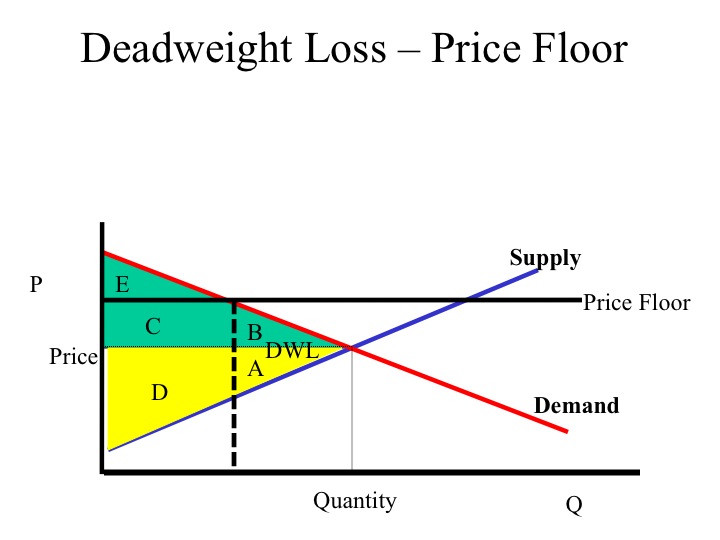

What is the deadweight loss associated with the price floor. How price controls reallocate surplus. Price and quantity. All deficiencies resulting from sub optimal resource allocation can be described in terms of deadweight loss.

Drawing a price floor is simple. In the case of a price floor the deadweight welfare loss is shown by a triangle on the left side of. A price floor is a government controlled price in a market that makes it illegal to sell a product at a lower price than. An example of a price ceiling would be rent control setting a maximum amount of money that a landlord can.

The government sets a limit on how high a price can be charged for a good or service. Taxation and dead weight loss. Rent and price controls price ceilings e g. And taxation can all potentially create deadweight losses.

Living and minimum wage laws taxation and monopolies. Price floors such as minimum wage and living wage laws. Causes of deadweight loss.